In the modern world, mobile devices have become necessary. With this increasing reliance on technology, ensuring the safety of our devices through mobile insurance coverage is paramount. This comprehensive guide delves into the benefits, types, and essential details of mobile insurance to help you make an informed decision.

Understanding Mobile Insurance

What is Mobile Insurance?

Mobile insurance is a specialized form of insurance designed to cover damages, losses, or theft of mobile devices. As smartphones and tablets become more advanced and expensive, the financial risk associated with their damage or loss increases. Mobile insurance mitigates this risk by providing financial coverage for repairs or replacements.

Why Do You Need Mobile Insurance?

Protection against accidental damage is one of the primary reasons to invest in mobile insurance. Accidents happen, and whether it’s a cracked screen, water damage, or any other unforeseen incident, mobile insurance ensures that you won’t bear the full cost of repairs.

Theft coverage is another critical benefit, as mobile theft is a common occurrence. Insurance can provide peace of mind by covering the cost of a stolen device.

Loss coverage is essential for those who frequently misplace their devices. In cases where your device is lost, mobile insurance can cover the cost of a replacement. Travel protection is an additional benefit, with some policies offering coverage even when you are traveling abroad, ensuring your device is protected wherever you go.

Types of Mobile Insurance

Accidental Damage Insurance

Accidental damage insurance covers unexpected physical damages to your device. This includes screen cracks, liquid damage, and other physical impairments resulting from accidents. It is one of the most commonly purchased types of mobile insurance due to the high likelihood of accidental damage.

Theft Insurance

Theft insurance provides coverage in case your mobile device is stolen. This type of insurance often requires a police report to process the claim, ensuring that the theft is documented officially. It is an essential type of coverage for those living in areas with high theft rates or for individuals who frequently travel.

Loss Insurance

Loss insurance covers the replacement cost if you lose your mobile device. This is particularly beneficial for individuals who frequently misplace their devices. It offers peace of mind and financial protection in the event of a lost phone.

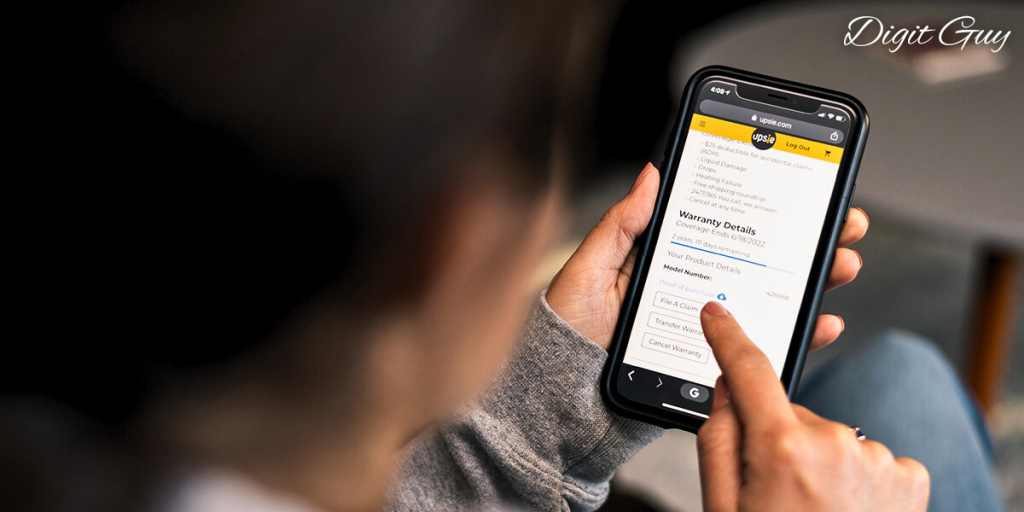

Extended Warranty Insurance

Extended warranty insurance prolongs the manufacturer’s warranty, covering mechanical and electrical failures beyond the initial warranty period. This can be invaluable for older devices that are more prone to breakdowns. It ensures that you can keep using your device without worrying about unexpected repair costs.

Comprehensive Insurance

Comprehensive insurance combines all the above types, offering a broad spectrum of coverage. It includes protection against accidental damage, theft, loss, and extended warranties. This type of insurance is ideal for those who want complete protection for their mobile device.

Key Benefits of Mobile Insurance

Financial Security

Mobile insurance provides financial security by covering the cost of repairs or replacements, ensuring that you are not left with a hefty bill in case of damage or loss. It mitigates the financial impact of unexpected incidents, allowing you to continue using your device without interruption.

Peace of Mind

Knowing that your mobile device is protected gives you peace of mind. You can use your device without the constant worry of potential damages or theft. This assurance is especially valuable for those who rely heavily on their mobile devices for personal or professional use.

Convenience

Many insurance policies offer additional conveniences such as expedited repairs or replacements, ensuring that you are not without your device for long periods. This quick turnaround can be crucial for maintaining productivity and staying connected.

Travel Benefits

Some mobile insurance plans include international coverage, providing protection for your device no matter where you are in the world. This feature is particularly beneficial for frequent travelers, ensuring their devices are protected against damages or theft abroad.

How to Choose the Right Mobile Insurance

Evaluating your needs is the first step in choosing the right mobile insurance. Consider how often you use your device, the environments in which you use it, and your propensity for accidents or misplacements. This assessment will guide you in selecting the appropriate level of coverage. It is crucial to compare policies from various insurance providers. Look at what is covered, the cost of the premium, the deductible, and any exclusions. This comparison will enable you to identify the most cost-effective option.

Reading the fine print is crucial to understanding the terms and conditions of the policy. Look for any hidden fees or clauses that might affect your coverage. Checking the claim process is another important factor. A smooth and straightforward claim process is crucial. Research how claims are handled by the insurance provider and read reviews from other customers.

Considering the cost is also important. Balance the cost of the insurance with the level of coverage provided. Sometimes, paying a slightly higher premium is worth the extensive coverage and peace of mind it offers.

Common Exclusions in Mobile Insurance Policies

Pre-existing damage is typically not covered by most insurance policies. If your device was damaged before you purchased the insurance, those damages will not be covered. Intentional damage is generally not covered, as insurance is designed to protect against unforeseen incidents. Unauthorized repairs can void your insurance coverage.

If you repair your device through an unauthorized service center, the insurance may not cover subsequent issues. Cosmetic damage, such as scratches or dents that do not affect the device’s functionality, is often excluded from coverage. Non-compliance with policy terms, such as not reporting a theft within the specified time frame, can result in a denied claim.

Steps to File a Mobile Insurance Claim

When filing a mobile insurance claim, the first step is to report the incident. Inform your insurance provider as soon as the damage, theft, or loss occurs. Provide the necessary documentation, which may include a police report (in case of theft), proof of purchase, and photos of the damage. Complete the claim form provided by your insurance company accurately and thoroughly.

Submit the filled-out claim form along with the necessary documentation. Follow up with the insurance provider to ensure your claim is processed swiftly.

Top Mobile Insurance Providers

Several companies offer reliable mobile insurance policies. Some of the top providers include AppleCare+, Samsung Care+, SquareTrade, Asurion, and Worth Ave. Group. Each provider has its own strengths and weaknesses, so it’s essential to compare their offerings to find the best fit for your needs.

Conclusion

Mobile insurance is an invaluable investment for anyone who relies on their mobile device. By understanding the various types of coverage, benefits, and how to choose the right policy, you can protect your device against unforeseen damages, theft, or loss. Ensure you read the fine print, compare different providers, and select a policy that offers comprehensive coverage to suit your needs.

FAQ’s

What does mobile insurance typically cover?

Mobile insurance typically covers accidental damage, theft, loss, and extended warranty for mechanical and electrical failures. Comprehensive policies may combine all these coverages to offer broad protection for your device.

How do I file a claim if my mobile device is damaged or stolen?

To file a claim, you should first report the incident to your insurance provider as soon as it occurs. Gather and submit the necessary documentation, such as a police report for theft, proof of purchase, and photos of the damage. Complete the claim form provided by your insurance company accurately and thoroughly, then follow up to ensure the claim is processed swiftly.

Are there any common exclusions in mobile insurance policies?

Yes, common exclusions in mobile insurance policies include pre-existing damage, intentional damage, unauthorized repairs, and cosmetic damage that does not affect the device’s functionality. Additionally, failing to comply with the policy terms, such as not reporting a theft within the specified timeframe, can result in a denied claim.

Can I get coverage for my mobile device when traveling internationally?

Some mobile insurance plans include international coverage, providing protection for your device no matter where you are in the world. This feature is particularly beneficial for frequent travelers, ensuring their devices are protected against damages or theft abroad.